Release Notes

Our Support Centres are Going Digital: Emails are Now Our First Priority

This is the digital age. As part of our transformation to digital support centres, we are pleased to announce that email inquiries will now be given first priority. This digital shift will allow us to process your requests even faster, and better meet your needs.

From now on, use emails instead of telephone to contact Customer Service and the Support Centre to save time and get accelerated service!

Try our Knowledge Base!

Consult our Knowledge Base to quickly find the information you need!

Our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

About

Warnings

Version 2022 1.0

Due to the late arrival of several CRA and Revenu Québec forms, the forms contained in this version have not been approved by the tax authorities. Therefore, do not submit any tax returns that have been prepared with this version to the CRA and Revenu Québec. The electronic transmission of the returns is not available in this version.

Note that, as in previous years, you can still start preparing your tax returns with version 1.0. However, upon printing, the forms will have the Do Not Submit watermark.

Version 2022 2.0

All the electronic services will be available in the next version of Personal Taxprep (2022 2.0), which is scheduled to be released in mid-February.

Version 2022 2.0 will be approved by tax authorities and will allow you to file personal income tax returns.

Training

To consult the different training options available regarding Personal Taxprep (seminars, webinars, tutorials and more), access the Training section of the Wolters Kluwer Web site. You can also access it from the program, by selecting Get Taxprep Training in the Help menu.

For Taxprep training, please contact the Professional Services team at learning@wolterskluwer.com.

Convert Preparer Profiles, Client Letters Templates, Print Formats, Filters and Diagnostics

In a new taxation year, remember that the preparer profiles, client letter templates, print formats, filters and diagnostics from the prior period must be converted.

Templates can be converted using the Convert function which is available in each template view. A File/Open dialog box will appear, and the folder opened will be the default location of the prior version template. Select an alternative folder if your prior version template is not in that location. Select all of the templates that you wish to convert.

Once your preparer profiles from last year are converted to the current year, it is important to verify that the options defined with respect to the returns of your clients and to the electronic filing of data (EFILE) still correspond to your situation for the current season. For more information on the new options offered in the preparer profiles of the current version, please refer to the “Modifications Made to Forms” section.

Electronic services prior years’ support

Federal

In addition to the current tax year 2022, the CRA also supports prior-year electronic services as indicated below until January 2024:

|

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

|

|

T1 EFILE (original returns) |

✓ | ✓ | ✓ | ✓ | ✓ | |

|

T1 ReFILE (amended returns) |

✓ | ✓ | ✓ | |||

|

T1135 |

✓ | ✓ | ✓ | ✓ | ✓ | |

|

Auto-fill my return (slips only) |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

|

Express notice of assessment (Express NOA) |

✓ | ✓ | ✓ | ✓ | ✓ |

* You will have to use the Personal Taxprep program for the year in question and update your EFILE password to the current year.

Québec

In addition to the current tax year 2022, Revenu Québec also supports prior-year electronic services as indicated below until January 2024:

|

2021 |

2020 |

2019 |

|

|

TP1 Netfile Québec (original returns) |

✓ | ✓ | ✓ |

|

TP1 Netfile Québec (amended returns) |

✓ | ✓ | ✓ |

|

Tax data download |

✓ | ✓ | ✓ |

* You will have to use the Personal Taxprep program for the year in question and update your EFILE password to the current year.

TaxprepConnect for the 2022 tax season

Important dates

Federal

February 6, 2023 – Opening of the Auto-fill T1 return service. The CRA tax data can be downloaded using TaxprepConnect.

Québec

February 20, 2023 – Opening of the Tax Data Download service. The Revenu Québec tax data can be downloaded using TaxprepConnect.

Modifications Made to Version 1.0

FORMS, SCHEDULES AND WORKCHARTS ADDED TO THE PROGRAM

Federal

T1B, Request to Deduct Federal COVID-19 Benefits Repayment in a Prior Year (Jump Code: T1B)

It is possible for individuals to claim a deduction for repayments made before January 1, 2023, of certain COVID-19 benefit amounts on their tax return for the year in which they received the benefit rather than on the return for the year in which they repaid the benefit.

Splitting the deduction between these two returns is also possible, provided that the total deduction does not exceed the total amount that has been repaid.

In other words, your can claim a deduction for the overpayment of the following federal COVID-19 benefits that you received in 2020 or 2021 and repaid in 2022:

-

the COVID-19 benefits include the Canada Emergency Response Benefit (CERB);

-

the Canada Emergency Student Benefit (CESB);

-

the Canada Recovery Benefit (CRB);

-

the Canada Recovery Sickness Benefit (CRSB); and

-

the Canada Recovery Caregiving Benefit (CRCB).

In the program, the deduction for the repayment of federal COVID-19 benefits in a previous year must be claimed through the new T1B form. The CRA will then automatically issue a notice of reassessment to reflect the deduction claimed; thus, there is no need for the individual to request an adjustment.

For Quebec residents, determining a 2022 deduction on the T1B will have the effect of claiming the same deduction on line 246 of the TP-1.D-V. To obtain an equivalent treatment in the Quebec return of a refund to be deducted in a previous year, a request for an adjustment using the TP-1.R-V form for the year in question is required.

Québec

QJ Reduction, Reduction of the tax credit for home-support services for seniors based on family income (Jump Code: QJ REDUCTION)

This worksheet is used to calculate the reduction of the tax credit for home-support services for seniors based on family income. For additional details on the worksheet, consult the Schedule J section.

Modifications Made to Forms

Notice to reader removed

As a result of the coming into force of the new Canadian Standard on Related Services (CSRS) 4200, Compilation Engagements, published by the Auditing and Assurance Standards Board, the software introduces changes to the Notice to Reader.

CSRS 4200 addresses compilation engagements, also referred to as “Notice to Reader” in practice and contains new conducting and reporting requirements. Therefore, to align with key changes, including scope and reporting standards, the Notice to Reader is taken from the software.

The removal of the Notice to Reader is showcased in the following locations in the software:

- removal of the Notice to Reader letter (Federal and Québec)

- removal of options in Preparer profile section related to Notice to Reader and disclaimers

- changes in Form ID, Letter C, Self-employment income statements, Form T777 and Form TP-59

The following is retained:

- the Custom mention option in preparer profile

- the default phrase in the “custom mention” section of the preparer profile

- the Engagement letter.

Federal

T1, Income Tax and Benefit Return (Jump Code: T1)

A section named Climate action incentive payment has been added on page 2 of the T1 return for the provinces of Alberta, Manitoba, Ontario and Saskatchewan following the removal of Schedule 14.

A section named Consent to share information – Organ and tissue donor registry has also been added to page 2 of the T1 return for the provinces of Ontario, Northwest Territories and Nunavut.

These two sections have been added to the form Identification and Other Client Information for each of the provinces concerned.

Immediate expensing measure

Note: The addition of this measure has begun in this version of the program and will be finalized in the next version, which is scheduled for February 2023. Note that the forms related to business, fishing, agriculture and real estate rental income are under review in version 1.0. In addition, the Québec forms TP.130.AD and TP.130.EN will be added in version 2.0.

The forms concerned by this new measure are:

-

T2125, Statement of Business or Professional Activities

-

T2042/Q2042, Statement of Farming Activities

-

T2121/Q2121, Statement of Fishing Activities

-

T776, Statement of Real Estate Rentals

-

T1163, Statement A – AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals

-

T1273, Statement A – Harmonized AgriStability and AgriInvest Programs Information and Statement of Farming Activities for Individuals

-

Partner/QPartner, Partner’s Income and Expenses Workchart

This broader measure provides that the capital cost of eligible depreciable property acquired after December 31, 2021, and available for use before January 1, 2024, by unincorporated businesses operated directly by individuals residing in Canada (other than trusts) and certain eligible partnerships may be deducted in full, up to a maximum of $1.5 million per taxation year. The limit must be allocated among eligible persons and partnerships that are members of an associated group. The limit allocated is also prorated for taxation years that are shorter than 51 weeks. The unused limit cannot be carried forward. The half-year rule is suspended for property eligible for this measure.

Eligible property is depreciable property subject to the CCA rules, other than property included in CCA classes 1 to 6, 14.1, 17, 47, 49 and 51.

A person or a partnership which puts into use eligible property with a capital cost that exceeds the allocated limit in a taxation year may decide to which class immediate expensing is allocated to. Then, the excess capital cost is subject to the regular CCA rules for each class. Eligible property that is also an AIIP in classes 43.1., 43.2 and 53 or a ZEV in classes 54 to 56 that already qualify for an enhanced CCA rate of 100% will not reduce the maximum amount available.

Area A, Calculation of capital cost allowance (CCA) claim

In the CCA tables in Area A, the following columns have been added for the calculation of immediate expensing:

-

Column 4, Cost of additions from column 3 which are designated immediate expensing property (DIEPs)

-

Column 6, Proceeds of dispositions of DIEP

-

Column 8, UCC of DIEP

-

Column 9, Immediate expensing amount for DIEPs

-

Column 10, Cost of remaining additions after immediate expensing

-

Column 12, Remaining UCC after immediate expensing

In additional, column 11, previously column 4 named Cost of additions from column 3 which are AIIPs or ZEVs, has been renamed Cost of remaining additions from column 10 which are AIIPs or ZEVs. As a result, the other existing columns have been renumbered accordingly.

Area G, Agreement between associated eligible persons or partnerships (EPOPs)

Area G, Agreement between associated eligible persons or partnerships (EPOPs), has been added to indicate the percentage of the immediate expensing limit assigned to each associated eligible person or partnership.

The Add and Delete buttons that are located at the top of the table allow you to manage the lines for associated individuals and partnerships for which the statement of activities has not been completed on the taxpayer's return and must be entered manually. When a client file is rolled forward, the data in the input fields will be retained.

Area G is identical for every statement of business or professional activities and of real estate rentals that is reported in the taxpayer’s return.

Area A, CCA other than classes 10.1 and 13

Lines corresponding to the columns in the CCA tables that are used for the calculations for this measure have been added to Area A, CCA other than classes 10.1 and 13 of the forms.

Area A, Additions and Dispositions Workchart

The question Is the property a designated immediate expensing property (DIEP)? has been added and is set to Yes by calculation when the acquisition date of the property is after December 31, 2021.

Area A, CCA Class 10.1

Lines corresponding to the columns in the CCA tables that are used for the calculations for this measure have been added to Area A, CCA Class 10.1 of the custom forms. In addition, the questions:

-

Is the property an AIIP?

-

Is the property a designated immediate expensing property (DIEP)?

-

Was the property a DIEP in a prior taxation year?

and line Disposition have been added to the CCA Class 10.1 forms.

As the immediate expensing measure includes a special recapture rule to address the possibility of excessive CCA when the vehicle has been designated for immediate expensing, this special rule is applied to adjust the proceeds of disposition to be deducted from the undepreciated capital cost of the property on the disposition of such a vehicle. Under this rule, the proceeds of disposition would be adjusted based on a factor equal to the depreciable value limit ($34,000 for vehicles acquired on or after January 1, 2022) that is relative to the actual cost of the car. When the vehicle is not designated for immediate expensing, the normal CCA and recapture rules for Class 10.1 property continue to apply.

The calculations used in the CCA Class 10.1 forms have been adjusted to account for this special rule.

CCA Class 13

Lines corresponding to the columns in the CCA tables that are used for the calculations for this measure have been added to Area A, CCA Class 13 of the custom forms.

Auto forms

Lines corresponding to the columns in the CCA tables of Area A that are used for the calculations for this measure have been added to the Auto forms. The CCA table has also been updated and is now identical for the CCA tables of Area A.

Optimization of calculations

When the capital cost of eligible property exceeds the limit allocated to the eligible person or partnership, the program allocates the latter amount, up to the lesser of the cost of the eligible acquisitions or the UCC balance, by prioritizing classes with a lower depreciation rate, but without exceeding the net income before CCA since the immediate expensing measure cannot be used to generate a loss.

RC71, Statement of Discounting Transaction (Jump Code: RC71)

Please note that the Canada Revenue Agency will not accept an RC71 form with an electronic signature until legislation is tabled and Royal Assent is received. Error 138 will be returned by the CRA if the electronic signature is used before Royal Assent has been received. The program has been updated in advance to allow you to use the electronic signature as soon as Royal Assent is received.

Clawback, Social Benefits Repayment (Jump Code: CLAWBACK)

Although some taxpayers may have received Canada Recovery Benefit (CRB) in tax year 2022 in respect of one or more 2021 benefit periods, CRA has confirmed that there will not be any CRB clawback for the 2022 tax year. As a result, the federal workchart for social benefits repayment has been modified to remove all calculations related to CRB clawback.

T4A(OAS) – Statement of Old Age Security (Jump Code: T4AOAS)

Starting in July 2022, the Old Age Security pension amount is increased for individuals who are aged 75 and over in June 2022.

In an instance where the individual turns 75 years of age after July 1, 2022, the increase will be paid in the month following the date of their 75th birthday.

The amount in box 18 (Taxable pension paid) is reported on line 11300 of the return.

T657, Calculation of Capital Gains Deduction (Jump Code: 657)

If you disposed of qualified farm or fishing property (QFFP) or qualified small business corporation shares (QSBCS) you may be eligible for the lifetime capital gains exemption (LCGE). Because you only include one half of a capital gain in your income, your cumulative capital gains deduction is one half of the LCGE.

The total of your capital gains deductions on gains arising from dispositions in 2022 of qualifying capital property has increased to $456,815 (i.e., one half of the LCGE increased by indexation to $913,630 for2022).

For dispositions of QFFP after April 20, 2015, the LCGE is increased to $1,000,000. This additional deduction does not apply to dispositions of QSBCS:

-

The limit on gains arising from dispositions in 2021 of qualifying capital property is $446,109 (one half of an LCGE of $892,218)

-

The limit on gains arising from dispositions in 2020 of qualifying capital property is $441,692 (one half of an LCGE of $883,384)

-

The limit on gains arising from dispositions in 2019 of qualifying capital property is $433,456 (one half of an LCGE of $866,912)

-

The limit on gains arising from dispositions in 2018 of qualifying capital property is $424,126 (one half of an LCGE of $848,252)

-

The limit on gains arising from dispositions in 2017 of qualifying capital property is $417,858 (one half of an LCGE of $835,716)

-

The limit on gains arising from dispositions in 2016 of qualifying capital property is $412,088 (one half of an LCGE of $824,176)

-

The limit on gains arising from dispositions in 2015 of qualifying capital property is $406,800 (one half of an LCGE of $813,600)

-

The limit on gains arising from dispositions in 2014 of qualifying capital property is $400,000 (one half of an LCGE of $800,000)

-

The limit on gains arising from the dispositions of qualifying capital property after 2008 and before 2014 is $375,000 (one half of an LCGE of $750,000).

Passenger vehicles – Increase of the capital cost ceiling for passenger vehicles in respect of capital cost allowance and maximum monthly deductible leasing costs purposes

On December 23, 2021, the Department of Finance Canada has announced, through a news release, the ceilings governing the deductibility of automobile costs and the rates used to calculate the value of taxable benefits related to the use of an automobile that will be applicable for the year 2022.

Effective January 1, 2022:

- the $55,000 ceiling applicable to zero-emission passenger vehicles (Class 54) will increase to $59,000 when such a vehicle is purchased after 2021;

- the $30,000 ceiling applicable to passenger vehicles (Class 10.1) will increase to $34,000 when such a vehicle is purchased after 2021;

- the ceiling will increase from $800 to $900 a month in respect of eligible deductible leasing costs for leasing contracts entered into after 2021.

The following forms have been updated to reflect the new rates, effective January 1, 2022, for vehicle acquisitions or leases:

- Forms AUTO and CCA 10.1 of Forms T2125, TP-80, T2042, Q2042, T2121, Q2121, T776, TP-128, T1163, T1273, as well as Forms T777 AUTO and T777 CCA.

First-Time Home Buyers’ Tax Credit

The amount used in the calculation of the First-Time Home Buyer’s Tax Credit increased from $5,000 to $10,000 for a qualifying home purchased after December 31, 2021.

Québec

Schedule E – Tax Adjustments and Credits (Jump Code: QE)

As a result of Bill 17, assented to February 24, 2022, the worksheet in Part C Property tax refund for forest producers has been modified to allow for a property tax refund even if the value of the forest management work for the year is less than the amount of the property taxes. Additionally, the changes allow for the reimbursement to be calculated across all assessment units instead of one at a time.

Schedule J – Tax credit for home-support services for seniors (Jump Code: QJ)

For the 2022 taxation year, the tax credit for home-support services for seniors has been increased from 35% to 36%. Additionally, the maximum eligible monthly rent is increased to $1,200 and a minimum eligible monthly rent of $600 applies for the purpose of calculating the tax credit.

Given the new calculation methods for the reduction based on family income, the calculation of the reduction of the tax credit for home-support services for seniors will be done in the new Worksheet QJ Reduction.

New calculation methods for the reduction for home-support services for seniors based on family income

Dependent seniors

A 3% reduction of the tax credit is applicable on the portion of family income that exceeds $61,725. This new reduction is only applicable with respect to the amount of the 1% increase, i.e., from 35% to 36% of the tax credit for home support for seniors.

Non dependent seniors

The credit is reduced based on two family income thresholds:

- The first threshold represents 3% for each dollar of family income in the given taxation year that exceeds the first applicable threshold ($61,725), up to the second threshold;

- The second threshold represents 7% for each dollar of family income in the given tax year that exceeds the second applicable threshold ($100,000).

TP-752.HA, Home Buyers’ Tax Credit (Jump Code: Q752.HA)

The maximum tax credit that can be claimed for the purchase of a qualifying home made on or after January 1, 2022, is increased from $750 to $1500.

Ontario

ON63052 – Ontario staycation tax credit (Jump Code: ON 63052)

This workchart has been added in the software to allow you to input the qualifying accommodation expenses paid and calculate the amount of the credit.

ON428-A – Low-income individuals and families tax (LIFT) credit (Jump Code: ON 428-A)

The individual and family income thresholds, phase-out rate, and maximum allowable credit for the low-income individuals and families tax (LIFT) credit have changed. The credit limit has been increased from $850 to $875.

ON479, Ontario Credits (Jump Code: ON 479)

A temporary, refundable Ontario staycation tax credit has been introduced for individuals or families residing in Ontario who have eligible expenses for leisure accommodation in 2022. The maximum claimable amount for this refundable credit can be up to $200 for an individual or $400 for a family.

A refundable Ontario seniors’ care at home tax credit has been introduced to help seniors with the cost of their eligible medical expenses. To be eligible for this credit, the family’s net income must be less than $65,000. The amount of the credit equals to 25% of the medical expenses claimed on line 58769 of form ON428. The maximum amount that can be claimed per person for this credit is $1,500. Given that the amount of this credit is based on the amount of medical expenses entered on line 58769 of Form ON428, it could be beneficial, in some cases, for a couple to split the medical expenses claimed. This would allow each of them to claim the refundable Ontario seniors’ care at home tax credit on Form ON479 and thus, potentially claim a combined amount for the couple greater than the amount that could otherwise be claimed by only one person. A diagnostic to inform you of this situation will be added to the next release of the program.

ON479-A, Ontario childcare access and relief from expenses (CARE) tax credit (Jump Code: ON 479-A)

The temporary 20% enhancement introduced in 2021 has been removed for 2022.

Bankruptcy information, Ontario's legislation changes (Jump Code: BANKRUPTCY)

Changes are being made to Ontario's legislation that prevent certain credits from being claimed when an individual is a bankrupt at any time in the calendar year that contains the taxation year. Thus, claiming is once again allowed in the year following the absolute discharge. The credits are as follows:

-

Ontario low-income individuals and families tax credit;

-

Ontario focused flow-through share tax credit;

-

Ontario childcare access and relief from expenses tax credit;

-

Ontario political contribution tax credit;

-

Ontario seniors’ public transit tax credit;

-

Ontario seniors care at home tax credit;

-

Ontario staycation tax credit.

Additionally, under the new provisions, the income of a bankrupt individual at any time in the calendar year is deemed to be nil for purposes of the Ontario Tax Reduction.

In the program, the checkbox The taxpayer is a bankrupt at any time in the calendar year containing the taxation year has been added to Form Bankruptcy. When the Yes checkbox is selected, the new provisions are applicable. This box is rolled forward as long as the absolute discharge from bankruptcy is not indicated.

Manitoba

MB479, Manitoba Credits (Jump Code: MB 479)

Changes have been made to the Education Property Tax Credit. The renters' component of the Education Property Tax Credit has been replaced by the new Renters Tax Credit.

Yukon

YT14, Yukon Government Carbon Price Rebate (Jump Code: YT 14)

Capital cost allowance assets in Class 56 are now eligible for the Yukon Business Carbon Price Rebate.

YT428, Yukon Tax (Jump Code: YT 428)

In Bill 12, the Yukon government has made some amendments to the Income Tax Act. The Business Investment Tax Credit is now claimed on Form YT428. In addition, refundable tax credits are no longer used in the calculation of the Yukon First Nations tax credit on Form YT432, which is now updated on Form YT428.

Nova Scotia

NS428, Nova Scotia Tax (Jump Code: NS 428)

The Volunteer firefighters and ground search and rescue tax credit has been moved from Form NS428 to the new Form NS479.

NS479, Nova Scotia Credits (Jump Code: NS 479)

This form allows taxpayers to claim the new refundable tax for children’s sports and arts activities. The maximum amount of expenses that can be claimed per child is $500.

The form also allows taxpayers to claim the tax credit for volunteer firefighters and ground search and rescue that was previously claimed on Form NS428.

Nova Scotia Child Benefit (Jump Code: PROV BEN)

Effective July 1, 2022, the calculation of the Nova Scotia Child Benefit has been changed. While this benefit used to outline different amounts based on the child's rank, the new calculation contains only one amount, regardless of rank. As a result, the calculation of the reduction has also changed, utilizing the amount allocated per child.

Forms removed

Federal

-

Schedule 14, Climate Action Incentive

Québec

-

TP-1029.9, Tax credit for Taxi Drivers or Taxi Owners

-

QEFILE TAXI, Summary of EFILE Data Fields - TP-1029.9

Corrected Calculations

The following problems have been corrected in version 2022 1.0:

Federal

Electronic Filing

Due to its early release date, this version does not allow for electronic filing. The forms related to EFILE are under review in this version.

Information about EFILE

Federal

Important dates

- February 6, 2023 – Opening of the system for electronic transmission of authorization requests.

- February 20, 2023 Opening of the EFILE On-Line transmission system.

- January 26, 2024 The CRA will stop accepting electronically filed T1 returns.

Registration and Renewal On-line

To renew your EFILE privileges for this year’s tax season, you must follow the instructions provided on the "Renewal" page on the CRA Web site at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/yearly-renewal.html.

To register as a new electronic filer, you must register online by completing the EFILE Registration On-Line form on the CRA Web site at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-businesses/efile-electronic-filers/yearly-renewal.html.

You will find more information concerning renewals and new applications at http://www.efile.cra.gc.ca/.

In order to be able to electronically file Form AUTHORIZATION, you must meet the following two criteria:

- Have a valid EFILE number and password; and

- Be a registered representative (online access).

A registered representative is a person who is registered with the CRA’s Represent a Client service. To register with the service, go to https://www.canada.ca/en/revenue-agency/services/e-services/represent-a-client.html

Québec

Important dates

- February 20, 2023 – Opening of the NetFile Québec system.

- February 20, 2023 – Opening of the Refund Info-line system.

- January 19, 2024 – Shut down of the NetFile Québec system.

NetFile Québec

- Tax preparers must register for “My Account for professional representatives” (available in French only), a secure space on RQ’s Web site, if they have not already done so in the past.

Note that renewal is automatic for persons who registered for this space in the past. - Consult the page “À qui s'adresse Mon dossier” (available in French only) to see which profile applies to you and what actions you can perform online on behalf of a business or an individual.

Roll Forward

Rolling forward 2021 client files

Your 2021 client files must be rolled forward using the Roll Forward command on the File menu, or from the Client Manager, if you want to do a batch roll forward, before you can access them with this version.

Planner Files

You can import client files created in Planner Mode in version 2021.

Slips

The roll forward is performed only for copies of slips in which amounts were entered last year as well as for copies including balances to carry forward, or attached notes or schedules to roll forward.

Attached notes

The attached notes are rolled forward, except if this option is cleared in the roll forward data options.

Rolling Forward ProFile, DT Max and TaxCycle client files (competitor products)

Make sure that the workstation’s regional settings are set to “English (Canada or United-States)” before rolling forward.

Notes – Attached Notes Summary (Jump Code: ATTN)

Schedule – Attached Schedule with Total (Jump Code: ATTS)

When rolling forward client files, the attached notes or schedules attached to fields in the comparative summaries are retained.

Technical Information

Technical Changes

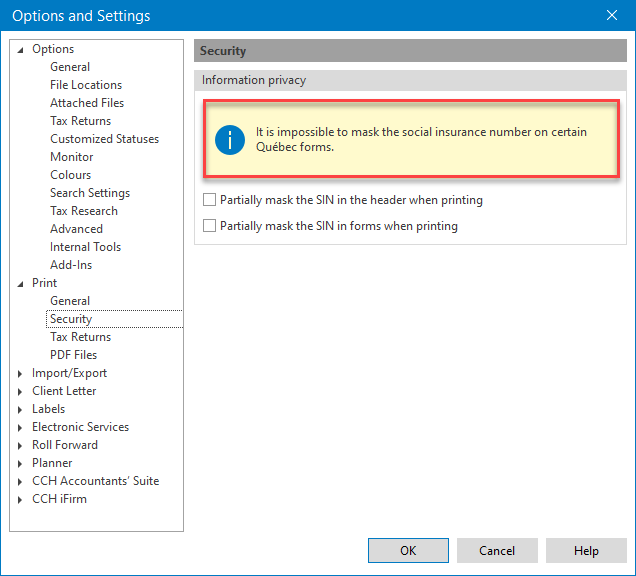

Partially masking the SIN on Québec forms

Revenu Québec has recently decided and confirmed that, with the exception of Forms TP-1000.TE (Online filing of the personal income tax return by an accredited person) and MR-69 (Authorization to Communicate Information or Power of Attorney), it does not accept hidden SINs on documents that are paper-filed, as this is not in accordance with its processing standards.

The security options that are accessible in the Security subsection of the Print section in the Options and Settings have been adjusted accordingly.

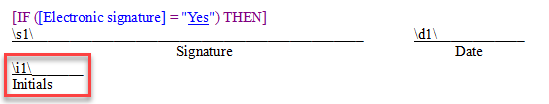

Electronic signature – Adding initials

It is now possible to add an e-tag so that a signatory's initials are included in a custom letter when using the electronic signature feature.

With the exception of the Engagement letter which contains the s1 and d1 e-tags, customer letters do not have e-tags integrated by default. To add the main taxpayer’s initials, you must add the \i1\ e-tag to your custom letter, as shown in the example below:

Note that it is also possible to add the spouse’s initials by adding the \i2\ e-tag.

Where:

\s1\ corresponds to the e-tag;

\d1\ corresponds to the signature date; and

\i1\ corresponds to the initials.

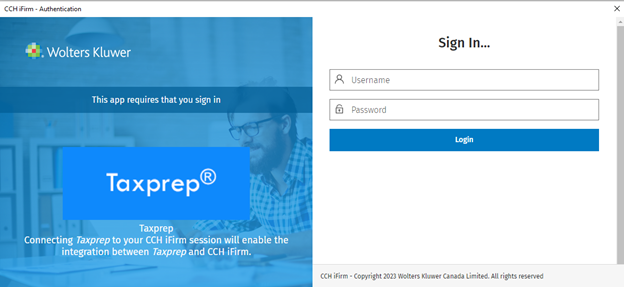

Batch synchronizing CCH iFirm portal information

It is now possible to synchronize multiple client files with the electronic signature information found in CCH iFirm Portal through the Client Manager view. In addition, the CCH iFirm Log that is displayed when the synchronization is complete now contains statistics that provide a view of the number of taxpayers for whom the synchronization was successful, those for whom an error occurred, or those for whom no information was synchronized. For more information, please consult the topic Synchronizing information from the CCH iFirm portal.

Printing the notice of assessment

It is now possible to print the notice of assessment through Taxprep. To this end, the Print Express NOA option has been added to the Print button ( ) located in the toolbar, as well as in the File menu. It is possible to customize the naming syntax of the express notices of assessment in PDF format to avoid having to rename them when generating a PDF file. This feature is available in the PDF Files subsection of the Print section in the Options and Settings.

) located in the toolbar, as well as in the File menu. It is possible to customize the naming syntax of the express notices of assessment in PDF format to avoid having to rename them when generating a PDF file. This feature is available in the PDF Files subsection of the Print section in the Options and Settings.

Taxprep Dashboard 2022 can now be used with Personal Taxprep 2022

With the Personal Taxprep 2022 release, you can now use Taxprep Dashboard 2022 with your personal tax program.

Taxprep Plus is now integrated with the Personal Taxprep installation

Taxprep Dashboard is now part of the CCH iFirm ecosystem.

The separate installation of the Taxprep Plus add-in is no longer required, as Taxprep Dashboard will now automatically be installed with Personal Taxprep.

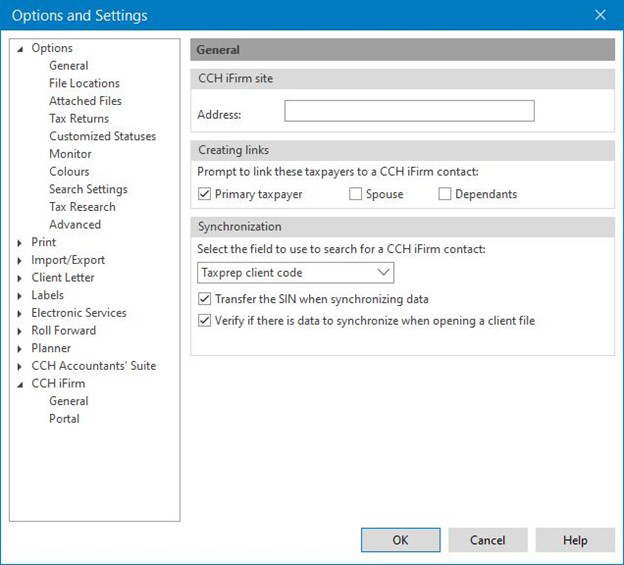

To activate Taxprep Dashboard for a user, you must:

-

Register with Taxprep (see Figure 1);

-

Restart Personal Taxprep;

-

Select the Taxprep Dashboard checkbox in the Options > Add-Ins section of the Options and Settings dialog box in Personal Taxprep;

-

Enter the CCH iFirm site address in the CCH iFirm > General section of the Options and Settings dialog box (see Figure 2);

-

Connect to CCH iFirm (see Figure 3).

Consult the Taxprep Dashboard release notes for more information on the integration of Taxprep Dashboard in the CCH iFirm ecosystem.

Figure 1

Figure 2

Figure 3

Where to Find Help

If you have any questions regarding the installation or use of the program, there are several options for getting help. Access the Professional Centre for tips and useful information on how to use the program. If you are in the program and need help, press F1 to get help on a specific topic.

In addition, our Knowledge Base contains an array of articles answering technical and tax questions most frequently asked to Support Centre agents. All you need to do is enter a few key words and the articles display in order of relevance to provide you with valuable information that will accurately answer your questions.

Videos available in the Professional Centre and on our Web site!

To learn more about Taxprep or to become familiar with the different features, consult the videos available in the Professional Centre.

Taxprep e-Bulletin

For your convenience, you are automatically subscribed to the Taxprep e-Bulletin, a free e-mail service that ensures you receive up-to-date information about the latest version of Personal Taxprep. If you want to review your subscription to Taxprep e-Bulletin, visit https://support.wolterskluwer.ca/en/support/ and, in the Newsletter section, click Subscription Manager. You can also send an e-mail to cservice@wolterskluwer.com to indicate the products for which you wish to receive general information or information on our CCH software (Personal Taxprep, Corporate Taxprep, Taxprep for Trusts, Taxprep Forms or CCH Accountants’ Suite).

How to Reach Us

Customer Service:

cservice@wolterskluwer.com

Tax and Technical support:

csupport@wolterskluwer.com

Telephone

1-800-268-4522